The mayonnaise market trends is stable yet growing and is forecasted to reach USD 13.8 billion by 2026. Mayonnaise is one of the growing sauce categories worldwide. Mayonnaise’s growth is caused by changing consumer choices towards newer, healthier quality spreads. In this blog, we will discuss the drivers of demand, market pressure, and actionable examples of how businesses can succeed in the sauce category.

Mayonnaise Market Size & Forecast for 2026

The demand for India mayonnaise market is expected to rise around the world through 2026. The global mayonnaise market is estimated to be between USD 12.4 billion and USD 15.63 billion, depending on the growth rate, somewhere between 4.5% and over 12%.

Both North America and Europe are highly dependent on the retail and foodservice channels. In APAC and India, there is movement with new flavours and adding healthy applications through usage in snacks and ready-to-eat meals. Private label continues to take market share while the foodservice segment continues to drive mayonnaise in bulk.

The Big 5 Trends Shaping Mayonnaise Demand in 2026

Mayonnaise trends in 2026 are being defined by significant market shifts shaped by consumer demands for clean-label mayonnaise. The rising eggless mayonnaise market and evolving supply dynamics.

- Clean label & functional ingredients: They include protein fortification, added fibre, and natural emulsifiers and are achieving stronger shelf presence and consumer trust.

- Eggless & plant-based: The eggless & plant-based surge is being led by vegan and flexitarian consumers, where eggless varieties now capture over 40% of the market in 2026.

- Demand for Bulk Packaging and Shelf-Stable Mayonnaise in the QSR & Foodservice: In the QSR(quick service restaurants) and foodservice, we have witnessed a sharp uptick in demand for bulk packaging and shelf-stable mayonnaise, driven by the ever-growing cloud kitchen and quick-serve segments of the industry.

- Emergence of Private Labels and Smaller Brands: Private labels and smaller brands are emerging rapidly, relying on nimble production approaches, local flavours, and lower-cost distribution.

- Supply Chain & Pricing Pressures: As we come back to supply chain and pricing pressures, especially on edible oils and packaging, these strains are directing both strategic procurement and innovative costs across the category.

Read More: Choosing The Right Mayonnaise Machine: A 3-Minute Industrial Buyer’s Checklist

Winning Strategies for Mayonnaise in 2026

Now, let’s talk about the winning strategies for mayonnaise. As you know, in 2026, there are still business opportunities for commercial mayonnaise suppliers to increase their mayonnaise business. A fully developed market playbook aimed at understanding changes in consumer expectations and navigating an increasingly complex market.

Product Development Checklist

- Reformulating products should be based on clean label ingredients, including non-oils and natural emulsifiers (sunflower & pea protein), with protein or fibre fortification for a healthier alternative.

- The type of emulsifier should be dependent on the segment (egg-based, vegan, or allergen-free) and not compromise safety.

- Focus on producing allergen-free products and create functional characteristics in mayonnaise profiles for niche consumer targets.

Packaging Tactics

- Sachets for single-serve/on-the-go products, squeezable bottles for retail sell-through, and bulk for QSR.

- Natural exploration of alternative sustainable or shelf-stable solutions that utilise recyclable plastic and new barrier alternatives.

Pricing and Distribution

- Incorporate value-based retail packs into grocery retailing, supermarkets, and online grocery retailers.

- Establish collaborations with quick-service restaurants and co-manufacture your private label partnerships to facilitate growth and secure your supply chain.

- Fulfil additional purchasing units concentrated on higher sales via volume discounts, multipacks, case discounts, and partnerships with distributors.

Marketing Playbook

- Develop regional flavours that complement regional cuisine trends, aimed at a premium brand offer for urban millennials.

- Commit to targeted digital advertising, paid brand influencer partnerships, and a thoughtful SEO strategy.

- Do product demos and sampling at targeted B2B locations.

Why Mayonnaise Machines Are a Growth Lever for Manufacturers

Increasing Production to Meet Demand

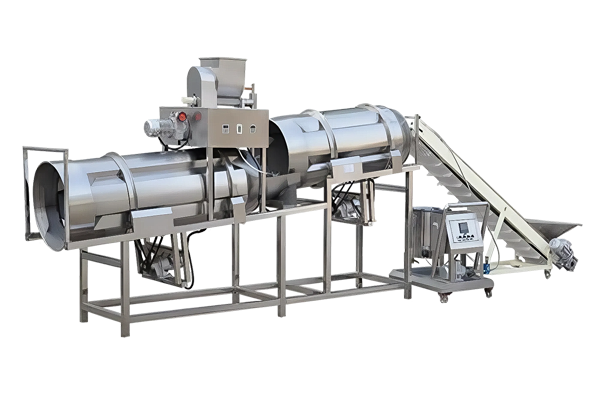

- Commercial mayonnaise-making machines allow manufacturers to quickly scale your production while keeping a consistent quality of output. A machine helps to emulsify the ingredients consistently to achieve the proper smooth consistency and helps to produce an output more reliably from batch to batch, which is key for maintaining brand trust and quality.

- All machines are made hygienically from stainless steel (SS304/316) to acceptable food safety standards, which helps greatly to reduce contamination possibilities.

Cost Efficiency & Margins

- The quick automation of commercial mayonnaise-making machines can save manufacturers money by drastically decreasing labour processes, addressing mixing, emulsification, and filling.

- The manufacturer can control the ratios of the various ingredients and save money on ingredient losses, improving yields and the consistency of the final product.

- The machines can continuously run and be high-production machines with the use of vacuum homogenising, increasing production capacity while decreasing downtimes and improving margins and profitability for the manufacturer.

Versatility in product innovation

- Currently, manufacturing equipment primarily intended for the production of mayonnaise has as a baseline the ability to produce several mayonnaise-based products. For example, traditional egg mayonnaise, eggless or vegan mayonnaise, lower-fat mayonnaise, and flavoured mayonnaise.

- By determining these different mayonnaise products, manufacturers will have greater flexibility. And be able to trial new formulations without any quality and safety concerns.

Food safety compliance and food quality enhancement standards

- Leading suppliers of mayonnaise machines build equipment with specific hygienic and food safety compliance and quality enhancement standards.

- As defined by government and regulatory bodies such as the Food Safety and Standards Authority of India (FSSAI) and a global food safety management system (FSMS) standard, such as the FSSC 22000.

Read More: The ₹5 Crore Secret: How to Start A Mayonnaise Business in India With One Small Machine

How the Mayonnaise Market Trends Is Performing in 2026

The worldwide mayonnaise market is growing rapidly, projected to have a CAGR of approximately 12.38% from 2026 to 2034, providing a significant chance for each manufacturer to invest in automated mayonnaise-making equipment. In fact, manufacturers using automated mayonnaise-making machines have found better margins with the new technology, with as much as a 15% increase due to reduced raw material waste, decreased labour costs, and processing efficiencies.

Quick reorder cycles are now commonplace, as automated lines can provide a consistent flow of output in high volume to support demand in retail and foodservice. Foods that offer opportunities to reduce waste through the management of ingredients with dosing and emulsification technologies contribute to a better yield and quality.

Conclusion

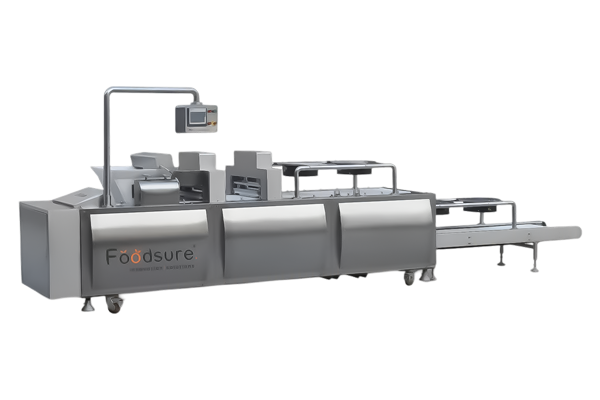

The mayonnaise industry in 2026 looks promising, but we all know that opportunity favours the prepared, and prepared with the demand, go-to-market strategy, and zeal for production. We’re working to improve the abilities of manufacturers to scale more successfully by utilising our Foodsure Machines to give them consistent quality, control waste, and react to changing consumer tastes. Our business philosophy can be summed up with this creed: make the right investments in strategy and machinery today, and you will be the market leader tomorrow.

WANT TO ENTER THE MAYONNAISE MARKET IN 2026?

Start Your Mayonnaise Manufacturing Business with Expert Support

The global mayonnaise market is projected to exceed $18 billion by 2034, driven by rising demand, innovation, and expanding food brands. Foodsure Machines helps startups and manufacturers with complete mayonnaise production solutions, including formulation guidance, machine selection, and scalable manufacturing setup.

FAQ

Q1. How does the global mayonnaise market appear to be developing?

Ans: The global mayonnaise market is estimated to go from USD 12.4 billion to USD 15.63 billion by 2026, while it is anticipated to have global growth from a 4.5% CAGR to an estimated above 12% based on the geographical area.

Q2. What is the Indian mayonnaise market size?

Ans: The Indian mayonnaise market is forecasted to continue to grow and could reach an estimated USD 300 to 350 million by 2026, given growth in consumer sales and food service categories.

Q3. What country has the highest mayo consumption?

Ans: The United States is the highest consumer of mayonnaise, followed closely by several countries in Europe. The APAC markets are growing quickly, specifically Japan and India.

Q4. What are the current trends in the mayonnaise market?

Ans: Rising demand for eggless, flavored, and health-focused mayonnaise.

Q5. Are mayonnaise prices increasing?

Ans: Yes, prices are gradually rising due to raw material costs.

Q6. Which country consumes the most mayonnaise?

Ans: The United States leads global mayonnaise consumption.

Q7. Which is the world’s No. 1 mayonnaise brand?

Ans: Hellmann’s is widely recognized as the top global brand.

Q8. Why was mayonnaise restricted or banned in India at times?

Ans: Due to Salmonella concerns in unregulated production.

Q9. What is the Gen Z trend in mayonnaise consumption?

Ans: Preference for plant-based and low-fat mayonnaise.

Q10. What is the next big food trend in India related to mayo?

Ans: Flavored and fusion mayonnaise variants in packaged foods.

Q11. What is the best-selling mayonnaise brand in India?

Ans: Amul and Veeba lead sales in India.

Q12. What is the shelf life of commercial mayonnaise?

Ans: Typically 6–12 months if unopened.