Health-based eating habits are changing how consumers snack, and fox nuts are tapping into that space. More shoppers are looking to eat something light, low in fat, and still considered nutritious, and makhana fits the bill. The market in India was valued at INR 8.5 billion in 2024, and is on a rapid growth trajectory as it is projected to be nearly INR 19.6 billion by 2033. This steady, sustainable growth is being sustained with a 9.22% CAGR forecasted for the period from 2025-2033. Makhana is becoming a more mainstream solution as a real potential viable economic model, rather than simply a niche snack.

Why the Makhana Market Is Rising Faster Than Ever

- Around 60 to 65 percent of urban snack consumers are looking for healthy alternatives, which is making makhana front of mind.

- Indian makhana has now launched in over 20 countries across the US, the Middle East, and Europe, and it is still expanding in export markets.

- The flavoured profiles of peri peri, cheese, and herbs are not merely a niche offering anymore, now representing almost 30 percent of retail sales.

- Packaged snacks in India are generating a compound annual growth rate of 12 to 14 percent, and makhana is riding that wave directly.

- Most projections in the industry are forecasting a steady growth rate of a further 10 to 12 percent for the category in the next five years.

Top 5 Makhana Market Trends for 2026 and Beyond

Premium and exotic flavours

- Peri peri, Italian herbs, smoky BBQ, and caramel are getting real attention in modern stores

- Shoppers want simple, tasty options, and these flavours help makhana feel more familiar

- This shift is pulling makhana into the mainstream snack space

Rising global export demand

- Indian brands are shipping to the US, UK, Dubai, and Australia

- These markets see makhana as a clean, light snack

- Consistent quality is becoming essential for exporters

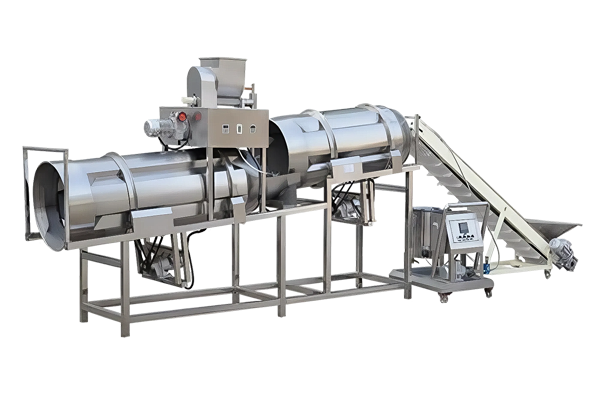

Shift toward automation

- Manual roasting has limits in scale and consistency

- Roasting machines give the same result batch after batch

- Brands use them to improve hygiene and increase output

Clean-label and vegan snacking

- People prefer snacks with fewer preservatives

- Low-oil recipes and simple seasonings are winning attention

- Clean labels help brands build trust quickly

Ready-to-eat makhana boom

- Convenience snacks are growing across retail and online

- Standardised roasting is needed to keep the taste steady

- Higher demand pushes companies to adopt better roasting systems

What’s Fueling the Demand for Advanced Makhana Machines

Consistency and Quality

Here’s the thing. Manual roasting swings a lot. Some kernels burn, some stay soft, and the flavour shifts from batch to batch. A good makhana machine keeps the heat steady and treats every kernel the same. The result is predictable colour, crunch, and taste.

Higher Production Output

Let’s break it down. You can’t meet growing orders with 20–30 kilos a day. Automated roasting lines push production into the 300–1000 kilo range without stressing the team. What this really means is you can sell to more buyers, and plan for wholesale or export without losing sleep over consistency.

Labour Efficiency

Most small units struggle with finding and keeping skilled workers. A modern roasting setup changes that. One trained operator can manage the line without running from one station to another. It cuts mistakes, reduces labour issues, and keeps the work predictable.

Read More: From Manual To Modern: How Advanced Makhana Processing Machines Transform The Industry?

Conclusion

At Foodsure Machines, we believe the makhana industry is entering its strongest growth phase. With the latest processing technology for roast makhana, we can help you achieve a higher level of quality and consistency. Ready to increase your capacity? Contact us for more information.

FAQ

Q1. What are the main trends impacting the makhana market through 2026?

Ans: Flavor options, clean-label snacks, and roasting and processing automation offer ways for brands to grow and to differentiate.

Q2. What is the health of demand in makhana today?

Ans: Demand is growing domestically in India and abroad as consumers look for lighter high high-protein snacks that are helping grow retail and export.

Q3. What are pricing trends for the makhana business?

Ans: Pricing is stable due to ongoing demand and increased processing, but baked/roasted/seasoned makhana offers premium margins.